Monetary Policy

Monetary Policy

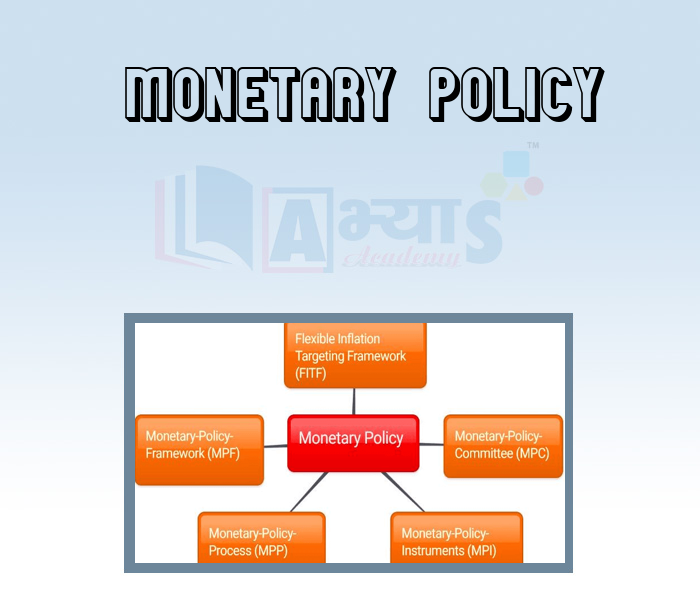

Monetary Policy: Monetary policy is the process by which the monetary authority of a country contrcls the supply of money, often targeting a rate of interest for the purpose of promoting economic growth and stability. The official goals usually include relatively stable prices and low unemployment. Monetary theory provides insight into how to craft optimal monetary policy.

Monetary policy is referred to as either being expansionary, or contractionary, Where an expansionary policy increases the total supply of money in the economy more rapidly than usual, a contracticnary policy expands the money supply more slowly than usual or even shrinks it. Expans:onary policy is traditionally used to try to combat unemployment in a recession by lowering interest rates in the hope that easy credit will entice businesses into expanding. Contractionary policy is intended to slow inflation in hopes of avoiding the resulting distortions and deterioration of asset values.

Monetary policy is contrasted with fiscal policy, which refers to taxation, government spending, and associated borrowing. Monetary policy rests on the relationship between the rates of interest in an economy, that is, the price at which money can be borrowed, and the total supply of money. Monetary poliey uses a variety of tools to control one or both of these, to influence outcomes like economic growth inflation, exchange rates with other currencies and unemployment. Where currency is under a monopoly of issuance, or where there is a regulated system of issuing currency through banks which are tied to a central bank, the monetary authority has the ability to alter the money supply and thus influence the interest rate (to achieve policy goals). The beginning of monetary policy as such comes from the late 19th century, where it was used to maintain the gold standard.

There are several monetary policy tools available to achieve these ends: increasing interest rates; reducing the monetary base; and increasing reserve requirements. All have the effect of contracting the money supply, and, if reversed, expand the money supply. Since the 1970s, monetary policy has generally been formed separately from fiscal policy. Even prior to the 1970s, the Bretton Woods system still ensured that most nations would form the two policies separately.

Within almost all modern nations, special institutions (such as the Federal Reserve System in the United States, the Bank of England, the European Central Bank, the People's Bank of China, and the Bank of Japan) exist which have the task of executing the monetary policy and often independently of the executive. In general, these institutions are called central banks and often have other responsibilities such as supervising the smooth operation of the financial system.

The primary tool of monetary policy is open market operations, This entails managing the quantity of money in circulation through the buying and selling of various financial instruments, such as treasary bills, company bonds, or foreign currencies. All of these purchases or sales result in more or less base currency entering or leaving market circulation.

Usually, the shorrt-term goal of open market operations is to achieve a specific short-term interest rate target. In other instances, monetary policy might instead entail the targeting of a specific exchange rate relative to some foreign currency or else relative to gold. For example, in the case of the USA the Federal Reserve targets the federal funds rate, the rate at which member banks lend to one another overnight however, the monetary policy of chine is to target the exchange rate between the Chineese currency and a basket of foreign currencies.

The other primary means of conducting monetary policy inculde:

(i) Discount window lending (lender of last resort)

(ii) Fractional deposit lending (changes in the reserve requirement)

(iii) Moral suasion (cajoling certain market players to achieve outcomes)

(iv) Open mouth operations (talking monetary policy with the market)

Students / Parents Reviews [20]

Abhyas institute is one of the best coaching institute in the vicinity of Ambala Cantt area. The teachers of the institute are well experienced and very helpful in solving the problems of the students.The good thing of the institute is that it is providing extra classes for the students who are w...

Aman Kumar Shrivastava

10thMy experience with Abhyas academy is very nice or it can be said wonderful. I have been studying here from seven class. I have been completing my journey of three years. I am tinking that I should join Abhyas Academy in tenth class as I am seeing much improvement in Maths and English

Hridey Preet

9thWe started with lot of hope that Abhyas will help in better understnding of complex topics of highers classes. we are not disappointed with the progress our child has made after attending Abhyas. Though need to mention that we expected a lot more. On a scale of 1-10, we would give may be 7.

Manya

8thAbhyas is an institute of high repute. Yogansh has taken admission last year. It creates abilities in child to prepare for competitive exams. Students are motivated by living prizes on basis of performance in Abhyas exams. He is satisfied with institute.

Yogansh Nyasi

7thMy experience with Abhyas academy is very good. I did not think that my every subject coming here will be so strong. The main thing is that the online tests had made me learn here more things.

Hiya Gupta

8thIn terms of methodology I want to say that institute provides expert guidence and results oriented monitering supplements by requsite study material along with regular tests which help the students to improve their education skills.The techniques of providing education helps the students to asses...

Aman Kumar Shrivastava

10thMy experience was very good with Abhyas academy. I am studying here from 6th class and I am satisfied by its results in my life. I improved a lot here ahead of school syllabus.

Ayan Ghosh

8thBeing a parent, I saw my daughter improvement in her studies by seeing a good result in all day to day compititive exam TMO, NSO, IEO etc and as well as studies. I have got a fruitful result from my daughter.

Prisha Gupta

8thAbout Abhyas metholodology the teachers are very nice and hardworking toward students.The Centre Head Mrs Anu Sethi is also a brilliant teacher.Abhyas has taught me how to overcome problems and has always taken my doubts and suppoeted me.

Shreya Shrivastava

8thAbhyas is a complete education Institute. Here extreme care is taken by teacher with the help of regular exam. Extra classes also conducted by the institute, if the student is weak.

Om Umang

10thThe experience was nice. I studied here for three years and saw a tremendous change in myself. I started liking subjects like English and SST which earlier I ran from. Extra knowledge gave me confidence to overcome competitive exams. One of the best institutes for secondary education.

Aman Kumar Shrivastava

10thAbhyas Methodology is very good. It is based on according to student and each child manages accordingly to its properly. Methodology has improved the abilities of students to shine them in future.

Manish Kumar

10thMy experience with Abhyas Academy has been very good. When I was not in Abhyas whenever teacher ask questions I could not speak it confidently but when I came in Abhyas, my speaking skills developed and now I am the first one to give the answer of teachers question.

Upmanyu Sharma

7thUsually we see institutes offering objective based learning which usually causes a lag behind in subjective examinations which is the pattern followed by schools. I think it is really a work of planning to make us students grab the advantages of modes of examination, Objective Subjective and Onli...

Anika Saxena

8thWhen I have not joined Abhyas Academy, my skills of solving maths problems were not clear. But, after joining it, my skills have been developed and my concepts of science and SST are very well. I also came to know about other subjects such as vedic maths and reasoning.

Sharandeep Singh

7thIt was a good experience with Abhyas Academy. I even faced problems in starting but slowly and steadily overcomed. Especially reasoning classes helped me a lot.

Cheshta

10thAbhyas academy is great place to learn. I have learnt a lot here they have finished my fear of not answering.It has created a habit of self studying in me.The teachers here are very supportive and helpful. Earlier my maths and science was good but now it has been much better than before.

Barkha Arora

10thAbhyas institute is one of the best coaching institute in the vicinity of Ambala cantt.The institute provides good and quality education to the students.The teachers are well experienced and are very helpful in solving the problems. The major advantages of the institute is extra classes for weak...

Shreya Shrivastava

8thIt has a great methodology. Students here can get analysis to their test quickly.We can learn easily through PPTs and the testing methods are good. We know that where we have to practice

Barkha Arora

10thIt was good as the experience because as we had come here we had been improved in a such envirnment created here.Extra is taught which is beneficial for future.